life insurance face amount and death benefit

The first death benefit option is a level death benefit. So if you buy a policy with a.

Pin On Infographics Life Insurance

The death benefit is the actual amount the carrier pays your beneficiaries and you can tack on additional benefits with riders.

. Permanent Protection That Lasts A Lifetime. In all cases life insurance face value is the amount of money given to the beneficiary when the policy expires. Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z fillF9C32D.

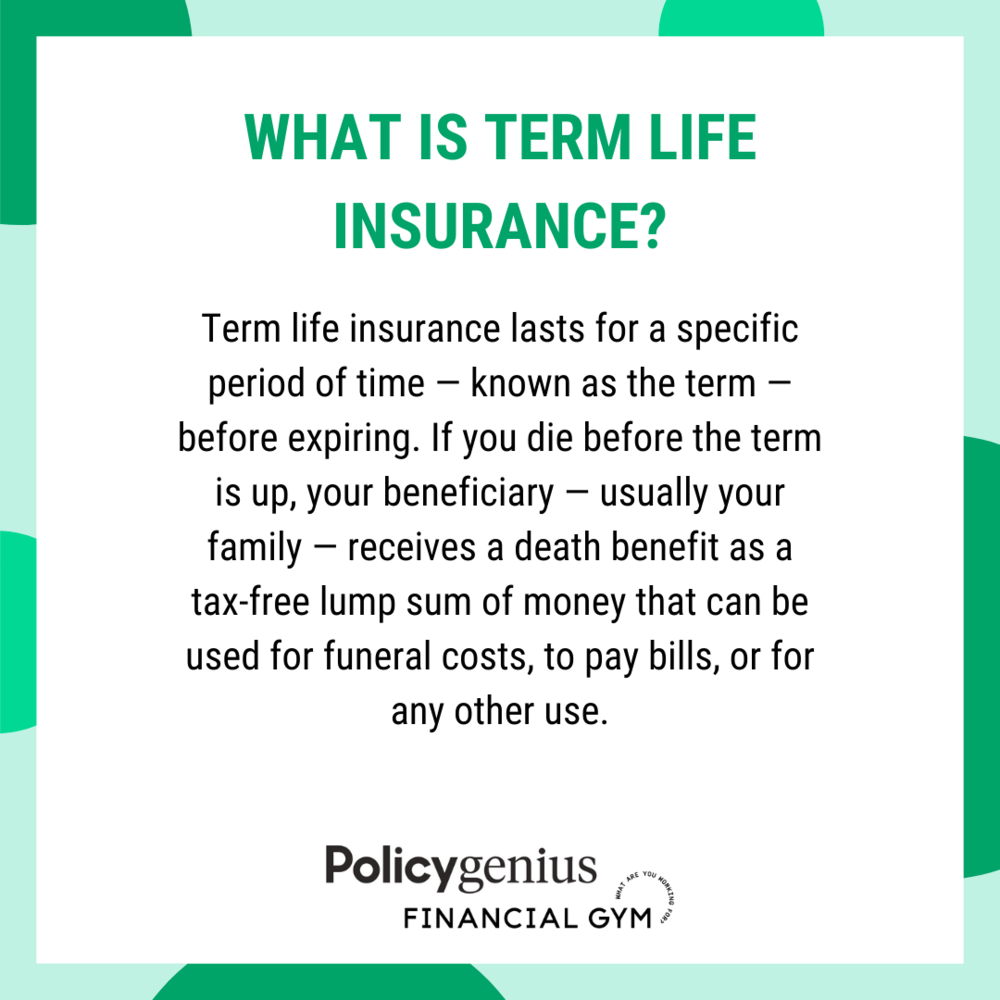

Call a licensed expert. See How Term Life Can Help Protect Your Familys Future. The death benefit is used to provide income for those that rely on the insured.

The face value does not always equal the death benefit particularly when you are dealing with permanent coverage such as whole life insurance that has accompanying riders such as PUA riders and term riders and also has life insurance dividends. It is used for life insurance policies. The face amount is the initial death benefit on a life insurance policy.

The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and is intended to be paid as a death benefit to your heirs. Ad Wonder How Much Does Life Insurance Cost. Life Insurance Face Amount May 2022.

This often goes by the name death benefit option A or 1. The death benefit is the amount of money that is paid out when a valid life insurance claim is filed. When a life insurance policy is identified by a dollar amount this amount is the face value.

Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity. On the contrary the death benefit is the amount of money that is paid to a beneficiary by an insurance company. Look No Further - We Compared The Best Companies.

The death benefit is paid to the stated beneficiaries of the contract which are determined by the owner before the insured person is deceased. The death benefit of your life insurance policy is just a technical term for face amount. The face value is typically how much your life insurance beneficiaries will receive if you die while your policy is in force.

The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and is intended to be paid as a death benefit to your heirs. Life Insurance Death Benefit Jun 2022. April 30 2021.

The death benefit can also be defined as the face value or face amount of a life insurance policy. The death benefit of a life insurance policy represents the face amount that will be paid out on a tax-free basis to the policy beneficiary when the insured person dies. The death benefit amount is determined when you first buy the policy and in many instances is equivalent to the face amount or face value of insurance.

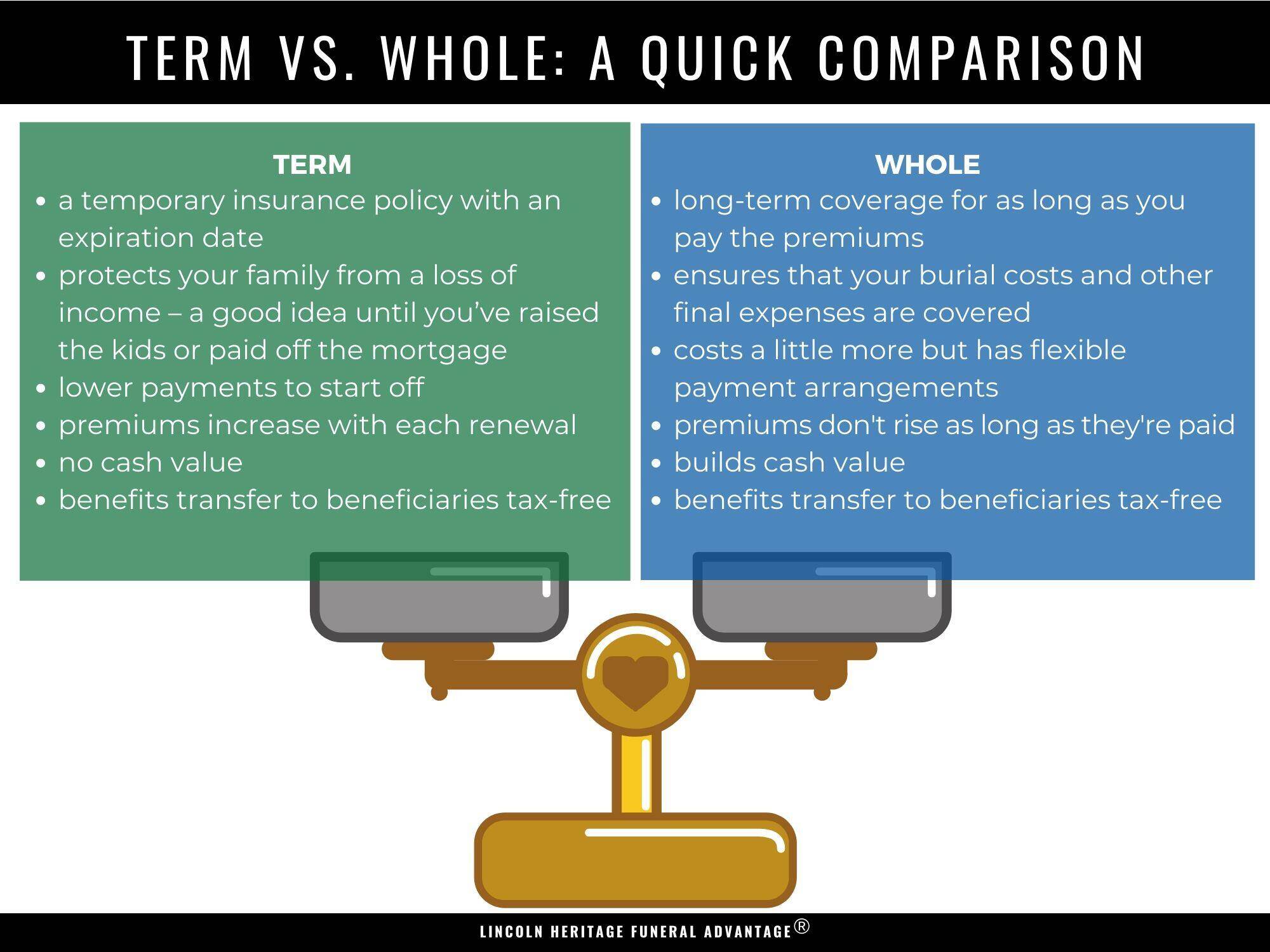

Your policys death benefit is the same as your policys face amount and vice versa. Permanent life insurances face amount is the death benefit paid to your beneficiaries and the cash value is a separate amount that you can use while youre still alive. When you discuss how much life insurance you need youre considering which face value is right for you.

Guaranteed Premiums That Never Go Up. The face amount is stated in the contract or application. Get Fully Covered By Top Providers Today.

The face value of life insurance is equivalent to the death benefit you select when purchasing a policy. The face amount death benefit remains level and cash value continues to earn interest and mature at age 100 single premium the entire premium is paid in a lump sum at the time of purchase and creates immediate cash value The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and. Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity.

At the beginning of the policy the face value and the death benefit are the same. Generally life insurance with a higher face value will cost more in premiums. All life insurance policies have a face value.

A 500000 policy therefore has a face value of 500000. Home Answers what is the difference between the face value and death benefit in whole life policy Asked July 10 2015. 2022s Lowest Life Insurance Costs Online.

It can also be referred to as the death benefit or the face amount of life insurance. For example if you buy a 100000 life insurance policy the face amount of that policy is 100000. The face amount or face value of a life insurance policy is the amount of money an insurer will pay out to beneficiaries if the policyholder passes away.

Generally life insurance with a higher face value will cost more in premiums. They both reflect the amount of money that the insurance company will pay out in the case of a valid claim. The Level Death Benefit Option maintains a constant death benefit amount throughout the life of the insurance policy regardless of accumulated values andor premiums paid by the policy owner.

How the Face Value of Life Insurance Works. Ad Easy Online Application with No Medical Exam Required Just Health and Other Information. The death benefit is the actual amount the carrier pays your beneficiaries and you can tack on additional benefits with riders.

The first step in figuring out the face value of your plan is visiting your benefits schedule. However as time. Its the amount of death benefit purchased which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies.

A 500000 policy therefore has a face value of 500000. The face amount of a life insurance policy tells you how much it pays out to your loved ones or beneficiaries when you die. Exclusive AARP Member Benefit.

Life insurance death benefit is the sum of money an insurer pays to beneficiaries upon your death provided the coverage was in force at the time of the event. But as the cash value of the policy changes over time it can alter the total death benefit either above or below the face. Normally the face amount is a round number like 50000 or 100000.

Endowment insurance provides for the payment of the face amount to your beneficiary if death occurs within a specific period of time such as twenty years or if at the end of the specific period you are still alive for the payment of the face amount to you. Ad Get A Personalized Burial Insurance Quote To Fit Your Budget.

Annuity Vs Life Insurance Similar Contracts Different Goals

Pin On Outline Financial Infographic

How Much Is A 1 Million Life Insurance Policy Who Needs It Life Insurance Policy Permanent Life Insurance Life Insurance Cost

Term Vs Whole Life Insurance 2022 Guide Definition Pros Cons

You Have Heard About Life Insurance And You Know It S Important But What Does It Really Mean Let S Find Out In Simplifying Life Life Insurance Policyholder

Group Life Insurance Life Insurance Glossary Definition Sproutt

Pin On Insurance Marketing Humor Estate Planning Chronic Critical Illness Annuities Tax Savvy Make Money

Check Out This Simple Overview Of Whole Life Insurance Wholelifeinsurance Topwholelife Quo Whole Life Insurance Life Insurance Quotes Life Insurance Policy

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Cash Value Life Insurance Life Insurance Life Insurance Agent Insurance Policy

Cash Value Life Insurance Life Insurance Glossary Definition Sproutt

Pin On Plan Future Ask For Life Insurance

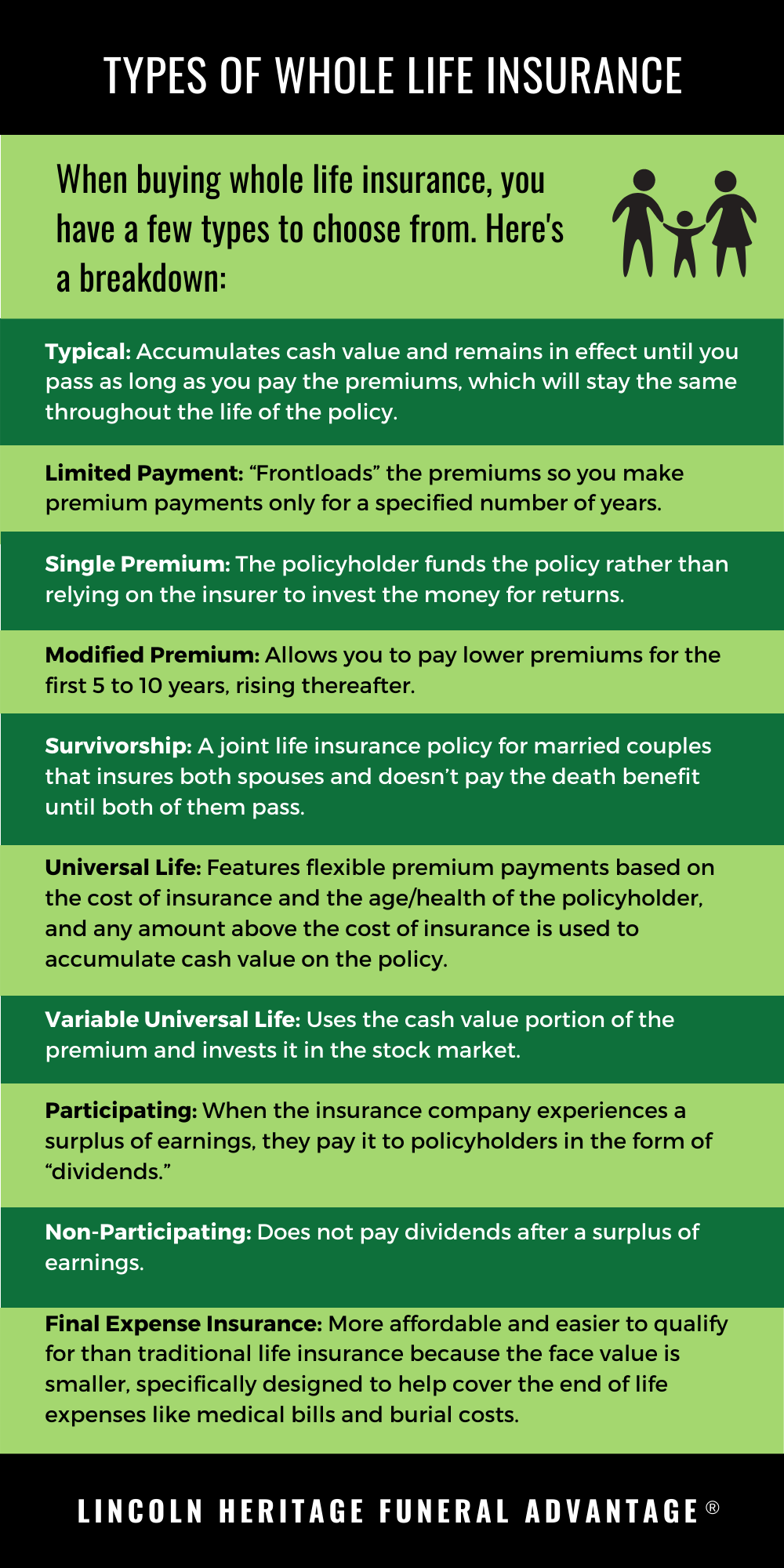

What Is Whole Life Insurance Cost Types Faqs

What Are Paid Up Additions Pua In Life Insurance

The Risk Of Surviving To Policy Maturity What Trustees Need To Know Ric Omaha

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)